With the world increasingly moving to cashless and contactless payments, the use of paper money is dwindling fast. But how many of us have thought about how the use of paper money came into being in the first place? Here, we take a look at the history of paper money – its origins, the ideas behind its inception, and the advantages and disadvantages of banknotes.

Some would have you believe that the digital age is around 50 years old, while others claim it began with the release of Apple’s iPhone in 2007. Irrespective of which is closer to the truth, there can be little doubt that this particular technological solution – one that has led to just about everyone carrying a computing device disguised as a telephone in their pockets – has led to a significant change in how we go about our daily lives.

THE CASHLESS REVOLUTION

It wasn’t that long ago that I could only board a bus into Nottingham if I had cash in my pocket. The times I was running late and was forced to make a detour via a cash machine on the way to my stop! A couple of years later, when I first moved to London, the opposite happened – I only had cash on me and was told by the driver that physical money was not an acceptable means of paying – it had to be via bank card, smartphone app or an Oyster card.

While this in some ways can be explained by my innate Luddite ways, it also shows how quickly the world is changing. Cash is becoming increasingly redundant – Big Issue sellers now carry contactless card machines, bank branches are closing at a rapid rate as customers move online and, in 2017, debit cards overtook cash as the most frequently used payment method in the UK for the first time.

Now that the death knell has been sounding for some time, I got to thinking: how did paper money come about in the first place? It is simply something I had never thought about before. So let us look through the history of paper money and see how we got to where we are today.

THE BEGINNINGS OF PAPER CURRENCY

Paper currency came about as a result of one (and perhaps, later, two) of the Four Great Inventions: papermaking, printing, gunpowder and the compass. Ancient China led the way, although it wasn’t until the Tang dynasty during the 7th century that merchants began using paper in the form of what would these days be called promissory notes.

The reason for this was simple: copper coinage had been used in China for centuries – and the coins were circular with a hole in the middle. The hole enabled rope to be thread through the coins to string them together. If a merchant was rich enough, the rope was too heavy to carry (boo hoo), so the coins were left with someone they trusted who gave them a paper receipt recording how much had been deposited.

It was some centuries before paper currency came to replace the need for coinage in some instances, but a precedent had been established and it was only a short leap from paper receipts to paper money.

JIAOZI – THE SONG DYNASTY

By the 11th century, during the Song dynasty, jiaozi (a form of banknote that is widely regarded as the world’s first paper money by numismatists) was being officially printed and issued. There was a shortage of copper from which coins were struck around the year 960, so the government issued the first banknotes and before long the economic advantages of printing paper money became apparent.

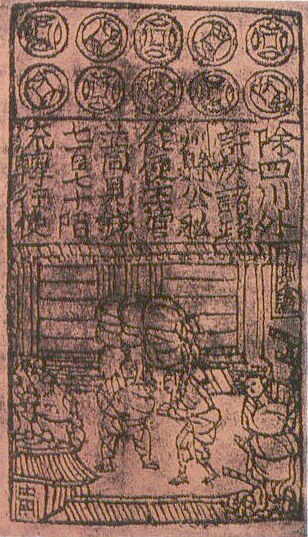

A jiaozi note depicting Chinese merchants inside a city

Over the next couple of centuries, the idea of paper money became so central to the economy that the Song government built factories in various Chinese cities to exclusively print the banknotes. According to Joseph Needham’s Science and Civilisation in China, by 1175, a factory at Hangzhou employed over 1000 workers – although it was still some time before the idea of paper money spread across China and was instead restricted to specific areas of the empire.

This changed between 1265 and 1274, when the Song dynasty issued a national paper currency standard that was backed by gold or silver. Paper money was now firmly established, to the extent that the designs of banknotes were often deliberately intricate to prevent forgery and counterfeiting.

THE IDEA TAKES HOLD IN EUROPE

It is often said that bad news travels fast but so too do good ideas – especially when Venetian globetrotter Marco Polo dedicates a portion of his unimaginatively titled book, The Travels of Marco Polo, to the subject of paper money. The chapter, imaginatively entitled ‘How the Great Kaan Causeth the Bark of Trees, Made into Something Like Paper, to Pass for Money over All His Country’, describes the use of paper money in Kublai Khan’s Yuan dynasty in the 13th century:

“With these pieces of paper…he [Khubilai Khan] causes all payments on his own account to be made; and he makes them to pass current universally over all his kingdoms and provinces and territories…and nobody, however important he may think himself, dares to refuse them on pain of death.”

Before long, European countries had taken China’s lead, beginning with similar promissory notes that later evolved into receipts to be used by way of payment.

BANKS BEGIN ISSUING BANKNOTES

By the 17th century, London’s goldsmith bankers were issuing receipts as payable to the bearer of the document, as opposed to the depositor (a sentiment echoed on contemporary banknotes with the sentence “I promise to pay the bearer on demand the sum of X pounds”), while 1661 saw Sweden’s Stockholms Banco become the first central bank to attempt to issue banknotes.

Unfortunately, the bank went bankrupt soon after and so it was left to the Bank of England – established in 1694 to help fund King William III’s Nine Years’ War against France – to start permanently issuing banknotes (which it did in 1695). Although these notes were originally handwritten to an exact amount, by 1745 they had become fixed denomination notes of between £20 and £1000 (the equivalent purchasing power of between £4650 and £232,000 today).

The Seven Years’ War (1756-1763) caused gold shortages that forced the Bank of England to start issuing £10 notes for the first time, with £5 notes coming in 1793. Ongoing war against Revolutionary France further drained the Bank’s bullion reserve and it wasn’t too much longer before £1 and £2 notes were being issued as a means of restricting the paying out of gold.

FUN FACT: the Bank of England’s nickname “The Old Lady of Threadneedle Street” is said to have derived from this period when gold payouts were extremely limited.

BANKS BEGIN ISSUING LEGAL TENDER

Here it is worth highlighting that until the early 19th century, any and all banknotes issued by central banks were merely promises to the bearer that they could redeem the paper for its value. However, in 1833, a Bank Charter Act decreed that banknotes were now considered legal tender – still, it took another 20 years before cashiers no longer had to sign each note individually and in 1853 the first fully printed notes began to appear.

Ultimately, the Charter Act of 1844 led to the establishment of what we now think of as the modern central bank and only the Bank of England could issue new banknotes. By 1921, the Bank of England had sole control of the money supply and new banknotes could only be issued if they were 100% backed by gold or up to £14 million in government debt.

Interestingly, the issuing of banknotes did not always solely rely on central banks or treasuries – particularly before official national currencies were established. Even today, the private issuing of banknotes continues in some countries (Scotland and Northern Ireland have their own banknotes for domestic circulation, while the Bank of England prints notes that are legal tender in England and Wales).

ADVANTAGES OF PAPER MONEY

As this article hopefully shows, there are many advantages of paper money and the creation of it as a means of exchange was often a result of circumstance and practical consideration. However, here we will take a look at some specific advantages that may not be obvious from the preceding text.

Paper Money Can Be Controlled Easily

The ‘elasticity’ of paper money is a key advantage. The supply of it can be easily controlled by governments, meaning that more can be printed if there is demand, but less can be produced if demand falls. This essentially means that a government can align its printing practices with the specific requirements of its economy at any given moment.

Paper Money Is More Stable

In relation to the above, the control of circulation means that the price stability of paper money is greater than it would otherwise be with other mediums of exchange. When Spain raided the Americas and brought loads of gold back to Europe, the value of it decreased as there was so much more of it about.

Paper Money Is Easily Moved

The weight of paper money is negligible, meaning that large amounts of money can be moved. Of course, this was not the case with gold or copper – which is what led to the creation of paper money in the first place.

Paper Money Is Easier To Count

If you have ever used an old spirit bottle to store saved coins and then had to count them before turning them into the bank, you will appreciate how much easier it is to count paper money than coins. A quick lick of the finger (or use of a thimble) is all that you need to be into the hundreds and thousands of pounds. Emptying your coin jar onto the table, stacking what you’ve counted, then transferring to bank bags takes far longer and will amount to much less money in a greater bulk.

Paper Money Can Be Used Quicker

The fact that we all acknowledge what a £20 note is worth means that it can be exchanged quickly. We all know it as legal tender so there are never any problems of it being accepted – especially as each note is secured against foreign security and gold reserves.

DISADVANTAGES OF PAPER MONEY

It would be remiss to not acknowledge that there are some disadvantages of paper money. Of course, the advantages significantly outweigh the disadvantages – why else would paper money have been continuously used since its inception? Still, it is worth highlighting some of the potential pitfalls.

Paper Money Can Bring Inflation

History has shown us the significant negative impacts that printing new banknotes can have upon a country’s economy. The hyperinflation that took place in the Weimar Republic in the early 1920s was a result of myriad reasons, but it was certainly in no small part because of Germany’s strategy of mass printing banknotes to pay war reparations – this ultimately led to the collapse in the value of the mark.

Paper Money Has An Unstable Exchange Rate

The sheer size of the foreign exchange market shows the instability of the exchange rate. While this can be highly profitable for traders, the wild fluctuations in the external price of any given currency against internal prices can have negative impacts on international trade and domestic economic growth.

Paper Money Can Be Damaged

Many of us will have washed a pair of jeans and discovered a crumpled £10 note inside one of the pockets. This shows how paper money is not as durable as coins. The new polymer notes that the Bank of England has started printing recently certainly helps to address some of the durability issues, as they are much stronger than paper.

FINAL THOUGHTS

In this article, a brief history of paper money has been presented, from some of the reasons behind the development of the idea, through to the issuing of legal tender by the Bank of England. Of course, with a history as colourful and chequered as that related to paper money, there is so much more that could be said – it would be impossible to document a comprehensive history of paper money without making this article somewhere near book length.

Still, it is worth considering how paper money came into existence, if only because so many recent reports appear to point to its impending demise. Still, although there are now more ways to pay for things than ever before, there are some reasons for thinking cash is here to stay – at least for the time being.

Consider that today, there are more than 70 billion pound’s worth of notes in circulation – around twice as much as there was a decade ago. Clearly, people still want and need to be able to pay for things with banknotes and will continue to do so for some time yet. It is easy for us in the UK, who have easy access to contactless technology and other ways of paying, to think that paper money is on the way out – but many people around the world rely on paper money to buy things.

Then there is the simple fact that cash is a means of payment that is convenient, reliable and anonymous – something that no other form of payment can claim. Often two of the three might be true of something like card payments or cryptocurrency, but nothing yet quite ticks all three boxes in the same way that cash does.