In a little over a decade, we have gone from the creation of the first decentralised cryptocurrency to a market that is now worth more than $3 trillion. So, how did we get here? In this blog, we try to answer that very question by tracing the history of cryptocurrency.

In 1983, when I was dragged, kicking and screaming, into the world, the American computer scientist and cryptographer David Chaum was busy conceiving ideas that were beyond me then and are beyond me now. These ideas were an extension of what had originally been proposed in his 1982 dissertation ‘Computer Systems Established, Maintained, and Trusted by Mutually Suspicious Groups’, where he first posited the notion of a blockchain protocol. From there, it was a short leap to the development of a form of electronic money he called ecash, which was implemented some years later in 1995.

Now, for the purposes of simplicity (and my own sanity), we need to skip over a few steps, but the important point to note is that Chaum’s dissertation proposed all but one of the elements that were later included in what has come to be known as the Bitcoin White Paper. This paper, written by Satoshi Nakamoto, was a precursor to the creation of the first decentralised cryptocurrency, bitcoin.

WHO IS SATOSHI NAKAMOTO?

Unlike Keyser Söze, the identity of Satoshi Nakamoto remains unknown. In fact, it is not even known if that is his real name, or whether it refers to one person or a group of people. Still, despite the mystery that surrounds him, many people have come forward to claim that they are Satoshi Nakamoto – something that someone wishing to remain anonymous would presumably not do. It is known that his crypto holdings are somewhere in the region of 750,000 to 1.1 million bitcoin, meaning his net worth is anywhere between £24 billion and £31 billion (using the BTC price at the time of writing). Given that, it is perhaps understandable that he wants to remain anonymous.

In many ways, the anonymity surrounding the identity of the person(s) directly involved in inventing bitcoin and implementing the first blockchain only adds to the mystique and enigmatic quality that crypto holds. How many of us can truly say we understand how it all works? The complex nature of digital assets and the inability to ever know certain aspects relating to them only adds to the allure and draws people in. There have been significant efforts by many major publications around the world to uncover the identity of Nakamoto but, as it stands, nothing definitive has been established.

Perhaps we will never discover who Satoshi Nakamoto is – but maybe that’s a good thing.

WHAT IS BITCOIN?

After Nakamoto published the aforementioned white paper, he went on to invent bitcoin in 2008 (the name bitcoin comes from a compound of the words bit and coin). However, it was not until 2009 that the currency was actually used – on 12 January of that year, the first bitcoin transaction occurred, when Nakamoto sent 10 bitcoins to the computer programmer Hal Finney (who, it has been claimed, is Satoshi Nakamoto). Then, in 2010, the first actual purchase was made using bitcoins, when Florida-based programmer Laszlo Hanyecz bought two pizzas for 10,000 BTC. If those same two pizzas were purchased for the same number of bitcoins today, each pizza would cost around £142 million.

The key principle behind the creation of bitcoin was that it would allow individuals to send money over the internet whilst operating outside of central control, or oversight by banks or governments. In some ways, the invention of bitcoin can be said to have been triggered by notions of ‘sticking it to the man’, although more recently, there are clear indications it is becoming increasingly institutionalised.

One of the key unique differentiators between bitcoin and other cryptocurrencies is that only 21 million bitcoins will ever be created. They are generated at a predictable and decreasing rate, with the number of new bitcoins issued per block decreasing by half around every four years. Once a figure of 21 million is reached, the issuance of bitcoins will be completely stopped – something that is estimated will happen around 2140.

HOW IS BITCOIN PRODUCED?

Before I attempt to answer the question of how bitcoin is produced, please understand how agonising it is for someone like me to get my head around it. Words, not numbers, are my thing (some would even challenge that), so bear with me. Bitcoins enter into circulation through a process of bitcoin mining, where computers attempt to solve an incredibly complex mathematical problem. The first computer to solve a given problem receives the next block of bitcoins and it all starts again.

It is difficult to comprehend just how complex these mathematical problems are. Because of this, mining bitcoin is extremely expensive and, by its very nature, only ever rewards a few who attempt to solve the problems. So why do people do it? Well, why do people do anything? I imagine that the sense of achievement felt by those who successfully solve a problem and get rewarded with bitcoin is similar to that I will feel once this blog has been written. However, it is also worth noting that mining actually has a purpose outside of financial reward – it is essential in legitimising and monitoring bitcoin transactions, and the fact that people around the world help fulfil these responsibilities ensures the decentralised aspect of bitcoin is upheld.

BITCOIN AND THE ENVIRONMENT

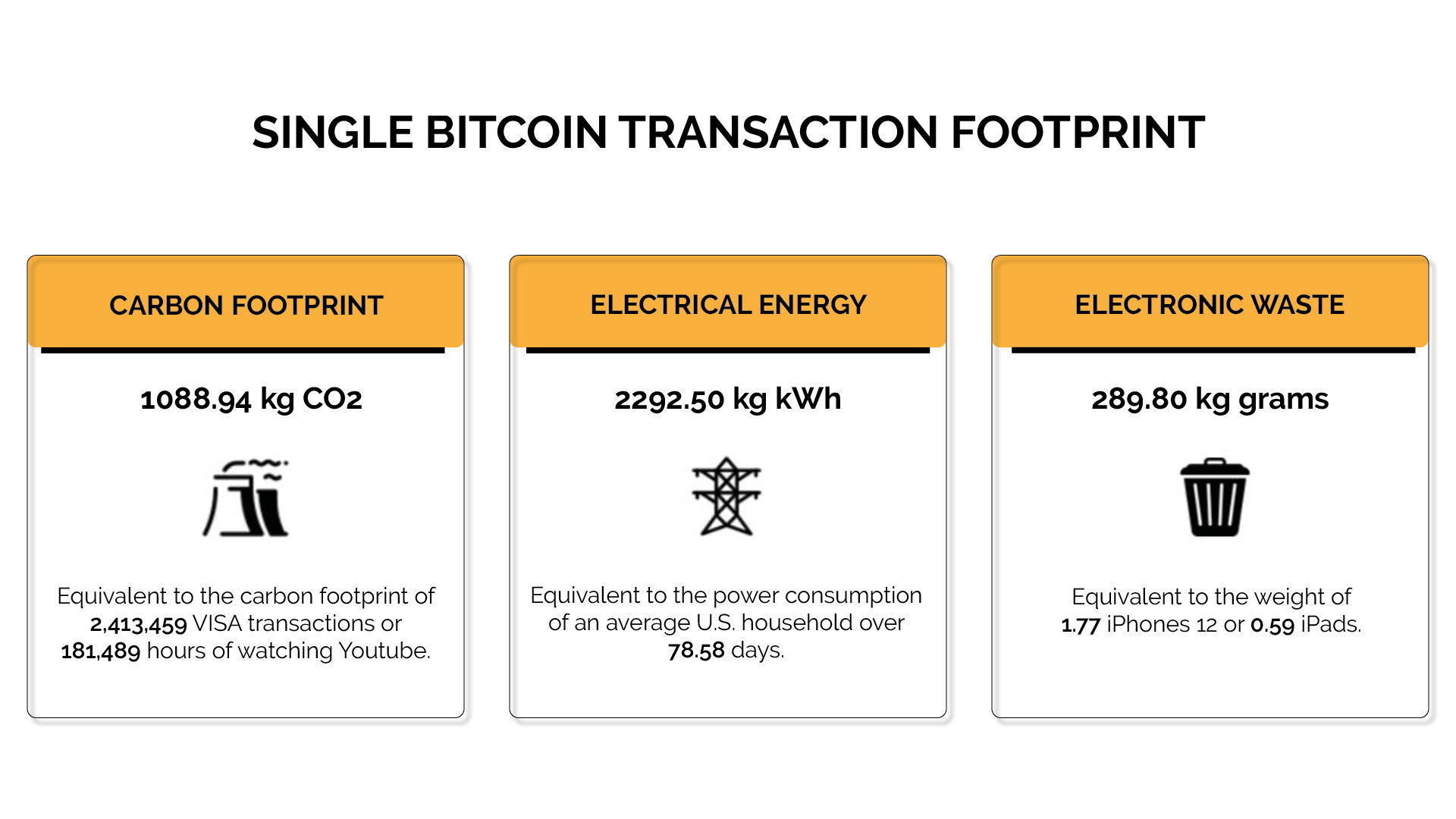

The production of bitcoin is not without its issues – there have been many recent reports regarding its environmental impact. Indeed, mining bitcoin requires incredible amounts of electricity to power the computers used to solve the problems, but there is also evidence to suggest a single bitcoin transaction burns 2,292.5 kilowatt hours of electricity. Finally, solving complex mathematical problems involves top of the range computers which requires regular upgrades to equipment. The throwing away of old equipment has been said to produce up to 30,000 tons of electronic waste each year.

As with any energy consumption that has significant adverse impacts on the environment, there are possible solutions, although some of those mooted are unrealistic. While renewable energy sources could, in theory, be used to mine bitcoins, there is no real incentive to do this (apart from moral or ethical concerns). Specific examples of this include bitcoin miners in China using hydropower from the south during the rainy season but, in this particular instance, it is only a temporary solution to an ongoing problem.

While the environmental impacts of bitcoin have gathered increased attention in recent months, it is a problem that was acknowledged by the aforementioned Hal Finney as early as 2009.

OTHER CRYPTOCURRENCY AKA ALTCOIN

Any blog centred on cryptocurrency is more or less obliged to go in heavy on bitcoin as that is where it all started. However, as I am sure you are all aware, there are many more cryptocurrencies out there. In 2013, there were just 66, but by January 2022 this figure had jumped to 9929 – a truly remarkable rise. One of the central ideas behind the development of other cryptocurrencies is to attempt to improve on the original design of bitcoin. These coins are sometimes referred to as alternative coins (altcoins), which literally means any cryptocurrency other than bitcoin. While some have taken off and achieved great popularity, bitcoin is still the leader, both in terms of its value and usage.

The popularity of digital currencies is there for all to see – despite being a little over a decade old, the cryptocurrency market is now worth more than $3 trillion and it is expected to continue rising in the coming years.

However, the appeal of investing in crypto took a while to take hold. One of the characteristics of bitcoin and other cryptocurrencies is their extreme volatility. For instance, at one point in December 2021, one bitcoin was worth $47,128 but by February, this figure had fallen to $36,439. Such significant movements can be scary but it is also part of the appeal – for whenever large sums of money can be lost, they can also be gained.

THE RELATIVE STABILITY OF STABLECOINS

Given the supposed inherent volatility of cryptocurrency, there have been attempts to develop cryptocurrencies that can boast a relatively stable price. Rather unimaginatively, these digital currencies are known as ‘stablecoins’, with the stability coming through their being pegged to a ‘stable’ reserve asset, such as US dollars or gold. In some ways, stablecoins can be seen as a bridge between most other cryptocurrencies and fiat currency, where the volatility is significantly reduced which, in theory at least, makes them more suitable for day-to-day business transactions or transfers between exchanges.

One of the most popular stablecoins is called USD Coin (USDC) and has proved to be an attractive means of storing and trading value within the crypto ecosystem. There are currently around 51.3 billion USDC in circulation, with hundreds of companies, products and services supporting the USDC standard. For customers with a US dollar bank account, 1 USDC can always be redeemed for US$1.00, meaning that it really does provide an effective alternative to fiat and cryptocurrencies – it can be thought of as just another way of paying for something, where you reap the rewards of utilising a decentralised means of payment without any of the volatility associated with almost all other cryptocurrencies.

CRYPTO HORROR STORIES

Let’s be honest – we have all heard someone claim that they once had loads of bitcoins but then sold them prematurely, how if they still had them now they would be a millionaire many times over.

Irrespective of the truth of these particular claims, there are definite instances you can read about that really do cause something hard and jagged to rise in the back of the throat. There is the story of the man who has forgotten the password to unlock his hard drive – which contains 7002 bitcoins. He wrote the password down on a piece of paper more than a decade ago, but has since lost it. He has had eight guesses at the password so far – after ten failed attempts the password will encrypt itself and the wallet holding the bitcoins will be impossible to access.

Then there is the incredible story of a man in Newport who accidentally threw away a hard drive containing the access key for thousands of bitcoins. Former IT worker James Howell mined the cryptocurrency in 2013, when it was worth a fraction of what it is today. When throwing away the hard drive, he mistakenly believed it was one without the equivalent of millions of dollars on it, but when checking the hard drive he had saved, realised his mistake. Since then, he has lobbied the local government to permit him to excavate the landfill where the hard drive is located, but Newport City Council are refusing to cooperate.

TOP TEN CRYPTOCURRENCIES

According to CoinMarketCap, the top ten cryptocurrencies (by market cap at the time of writing) are:

1. Bitcoin

2. Ethereum

3. Tether

4. BNB

5. USD Coin

6. Cardano

7. Solana

8. XRP

9. Terra

10. Dogecoin

It is said that the top 20 cryptocurrencies account for nearly 90% of the total market.

INSTITUTIONALISATION OF CRYPTOCURRENCY

Over the past couple of years, there have been signs that cryptocurrency is becoming increasingly institutionalised. Towards the end of 2020, PayPal announced that its customers would be able to buy and sell bitcoin and other digital currencies using their PayPal accounts; Visa has developed a range of crypto solutions and capabilities – with a webpage dedicated to extolling the virtues of crypto; J.P.Morgan has created its very own digital coin for payments; and there are various reports declaring that institutional money is pouring into the crypto market.

Of course, the outlook for crypto is not entirely rosy. China has announced that all cryptocurrency transactions are illegal, which effectively bans digital tokens; and Egypt, Iraq, Qatar, Oman, Morocco, Algeria, Tunisia and Bangladesh have done the same. Then there are the 40 or so other countries that have placed restrictions on banks’ ability to deal with crypto – which essentially bans digital currency transactions. In fact, the number of countries that have banned crypto (completely or implicitly) has more than doubled since 2018.

Part of the reason for putting these measures in place is that crypto is thought to be used to support illegal activities. While the decentralised nature of digital currencies is part of their appeal (and a key driver behind their inception), it also lends itself well to funnelling and laundering money. Until such hurdles can be overcome, it is unlikely that crypto will become entirely institutionalised – and overcoming those hurdles is extremely difficult without wholesale changes that could, in effect, fundamentally undermine the principles behind the reasons for cryptocurrency’s existence.

One possible alternative to banning crypto is to find a means of regulating digital currency – which would appear to be a happy medium (even if it would make many, many people very unhappy). There is no easy solution to all of this – it is all well and good for us to independently declare that we are happy to perform transactions with digital currency, but without the support of banking and payments service providers, it is essentially impossible.

CENTRAL BANK DIGITAL CURRENCIES

You have almost certainly heard thatEl Salvador became the first country to make bitcoin legal tender which was a huge step forward for those who are advocates for cryptocurrency, but the International Monetary Fund has recently called on the Latin American country to reverse its decision. The results of this urging remain to be seen, but governmental financial institutions across the world are certainly considering entering the cryptocurrency sphere – as is seen with the development of central bank digital currencies (CBDCs).

CBDCs would essentially function as an electronic version of physical money, with each being worth the same as the other.The Bank of England is said to be considering whether or not to introduce CBDC, while other central banks have already implemented them. As far back as 2014, China was working towards a release of a digital renminbi, but it has not yet been launched. The Atlantic Council has an absolutely fascinating CBDC tracker which shows a map of the world and provides a status update on which countries have launched a CBDC, are running a pilot, researching and developing them, or have cancelled the project.

As it stands, nine countries have officially launched a CBDC: The Bahamas, Nigeria, Antigua and Barbuda, Saint Kitts and Nevis, Montserrat, Dominica, Saint Lucia, Saint Vincent and the Grenadines (brilliant band), and Grenada. In the future, we can expect many more nations to follow suit, although there is still some work to be done on understanding exactly how introducing a CBDC will affect a given country’s economy. Ultimately, a CBDC will promote financial inclusion, although transactions will not necessarily be anonymous like they are with some cryptocurrencies.

I WISH THAT I KNEW WHAT I KNOW NOW WHEN I WAS YOUNGER

Crypto has come an awfully long way since 2009. What started as a theoretical idea has become a practical reality. Many of my friends own various forms of crypto (including meme coins which I simply cannot get into if I want to get this blog published this century), and none of them have the faintest idea what they are doing.

There is no doubt that digital currency is an effective means of performing transactions, but it would be remiss to ignore that it is also a new form of gambling. Those aforementioned friends invest their hard-earned cash with an idea that they might one day become multimillionaires – and let’s be clear – for every story of someone hitting the bigtime by purchasing a few thousand bitcoins years ago, there are many others who have lost their life savings by becoming embroiled in high-risk trading without having a clue.

Of course, there is a feeling of not wanting to get left behind. There was a time when people believed the internet would never take off and the world is ‘advancing’ at such a rapidly increasing rate that people are getting older and older at a younger and younger age. I feel totally out of touch now and I was a fresh-faced youth when I started writing this!

The point is that one day soon the key financial players in the world will ‘get with the programme’ and find a means of working with crypto in a way that is conducive to their operations. When they do, crypto will move from the fringes towards somewhere nearer the centre. It is not absurd to believe that digital currencies will one day become an essential part of our lives and that future generations will look at fiat as a stupid idea.

I just wish I had had the foresight to purchase 100 bitcoins in 2009. Then I would be sunning myself on a beach somewhere instead of having to write The History of Cryptocurrency.